The trucking industry, as well as telecom, utilities, and fleet service fleets have experienced a lot of headwinds over the past couple of years, ranging from the COVID-19 pandemic to labor shortages to supply chain disruptions. According to a new ATRI report, all of these companies can add rising insurance premiums to the list, despite their efforts to adopt new safety technologies.

Let’s take a look at what’s behind rising insurance costs and strategies that carriers and fleet managers can take to mitigate these costs.

How to Cope with Rising Fleet Insurance Costs Share on XWhat’s Behind Rising Insurance Costs?

Truck crash frequency and severity increased between 2009 and 2018, but insurance costs rose faster.

The FMCSA’s Large Truck Crash Causation Study found that mechanical defects, new tour routes, and fatigue were the most common causes of truck crashes. Contrary to popular belief, drug and alcohol abuse accounted for less than 1% of large truck crashes, while aggressive driving only directly affected 5% of cases.

Litigation is a significant factor influencing the rise in premiums. With the increase in both nuclear and small verdicts, incurred losses for insurers rose by about 50% between 2015 and 2019. As a result, insurers have passed on costs to customers, reduced coverage limits, or left the market altogether, putting upward pressure on premiums.

Many fleets reduced their coverage levels or increased their deductibles in response to higher premiums. While these cutbacks reduce premium costs, they increase exposure to nuclear verdicts and entail higher out-of-pocket costs. In addition, a third of fleets also cut wages or bonuses, while a fifth cut back on equipment and technology.

Mitigating Cost & Risk with Technology

The good news is that new safety technologies could address the underlying causes of crashes and reduce insurance premiums.

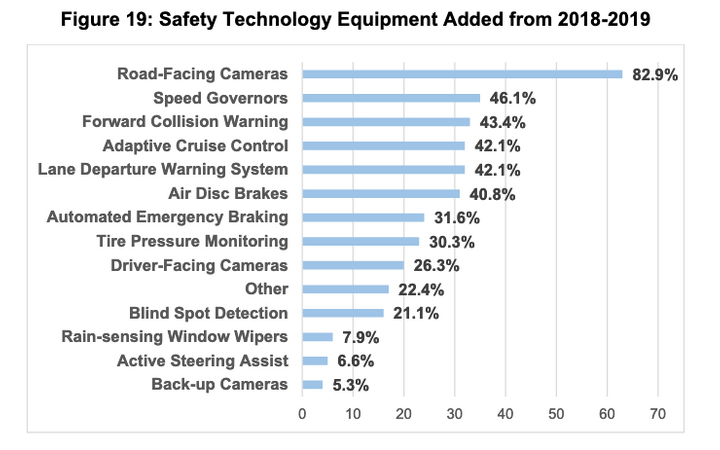

Road-facing cameras are the most popular solution. Source: ATRI

Road-facing cameras have been the most prevalent risk mitigation technology. In the event of an accident, they provide irrefutable documentation, lowering claims and defense costs. As a result, some insurance companies offer discounts to fleets that leverage these technologies to aid in the defense of legal claims.

Speed governors, forward collision warning systems, adaptive cruise control, lane departure warning systems, and other safety technologies can help prevent crashes. However, they don’t necessarily address the underlying causes of large truck crashes. Tire pressure monitoring systems and preventive maintenance may be better options.

It’s also essential to note that aside from camera systems, most safety technologies don’t directly impact insurance premiums. Instead, they reduce the risk that vehicles will experience an accident. The entire industry will have to adopt safety technologies to reduce the number of incidents before there is a widespread reduction in premiums.

For operations and fleet managers, integrated asset tracking can eliminate asset theft and improve utilization. Insurance premiums can be lowered by addressing emergency work orders quicker and more efficiently thanks to knowing where the nearest worker or asset is.

Adding built-in EV support creates the ability to instantly integrate new EVs into fleets. By capturing key data, fleets become safer with positive coaching techniques.

Harnessing the Power of Telematics

Telematics solutions address rising fleet insurance premiums in several ways, from actively reducing premiums via camera systems to lowering the risk of a crash to reducing costs to maintain profit margins. And the same solutions can help increase profitability, open the door to new revenue opportunities, and even improve driver morale.

Powerfleet is a global leader of internet of things (IoT) software-as-a-service (SaaS) solutions that optimize the performance of mobile assets and resources to unify business operations. For more than 20 years, our data science insights and advanced modular software solutions have helped drive digital transformation through our customers’ and partners’ ecosystems to help save lives, time, and money. Powerfleet’s tenured and talented team is at the heart of our approach to partnership and tangible success. In addition to a top-tier suite of technologies, we provide expert advice and help you maximize the benefits of these technologies—including minimizing the risk of an accident.

Powerfleet’s solution can help in several ways:

- Two-way communication and complex workflows avoid problems with new routes and ensure drivers have everything they need.

- Engine performance data identifies maintenance issues before they become problems and lead to costly accidents or breakdowns.

- HOS compliance solutions monitor driver activities to the minute, reducing errors and ensuring proper rest to avoid fatigue.

- Driver performance monitoring analyzes speeds, harsh braking, and sudden acceleration to spot unsafe driving habits in real-time.

- Connect key powered and non-powered assets to make sure the right assets are being used for a job.

- Integrated asset tracking eliminates asset theft and improves utilization.

- Tracking also allows for reacting and addressing emergency work orders quicker and more efficiently.

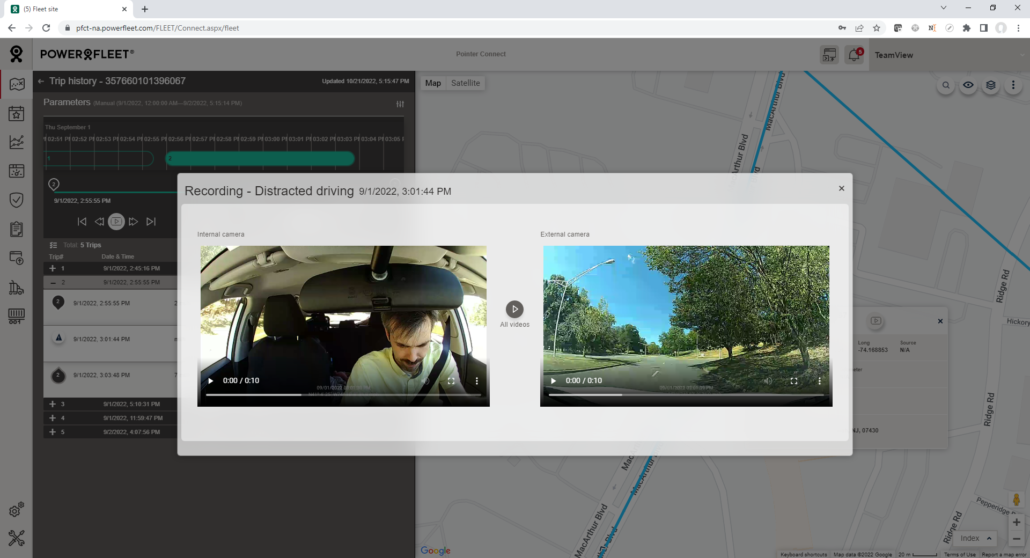

Powerfleet Vista makes it easy to keep an eye on your fleet. Source: Powerfleet

Meanwhile, Powerfleet Vista provides road and driver-facing cameras to bolster safety programs, help exonerate drivers, prevent accidents, increase security, and lower insurance costs. Leveraging the latest in AI technology, Vista can also analyze and proactively manage risky driving situations across your fleet before they become a problem.

When it comes to lowering insurance premiums, Powerfleet Vista helps address the low-hanging fruit by providing effective video solutions that may immediately lower insurance costs. Once video is in place, fleets can add telematics that prevent accidents and lower long-term risk, such as monitoring engine data for maintenance.

The Bottom Line

Insurance premiums have been rising over the past few years, thanks to an increase in both crashes and litigation. While safety technologies could help mitigate some of these costs, insurance premiums are likely to continue rising in the future. Camera and telematics systems will be vital to manage these costs over time.

Powerfleet provides a wide range of technologies and services to help minimize risk, lower premiums, and better manage your fleet. In addition, we offer cutting-edge, cloud-based software to aggregate, manage, and analyze telematics data so you can make data-driven decisions. You can access customer support any time you need it.

If you’re looking for ways to protect your fleet, contact us today to discuss how our telematics solutions could help.