The COVID-19 pandemic has taught us many lessons, but the most important is expecting the unexpected. After initial concerns over empty containers, consumer demand snapped back in February of last year, with record-breaking numbers of containers at ports and trailer shortages along domestic routes across the United States and Canada.

Let’s look at some of the underlying factors causing the trucking industry’s capacity issues and how the industry can adapt.

The COVID-19 pandemic led to numerous capacity issues for the trucking industry—we look at the problems and how technology could help solve them. Share on XRobust Consumer Spending Drives Demand

The COVID-19 pandemic had a significant impact on the amount of money consumers spend and how they spend it.

The price of everyday goods and services rose at a 5.4% annual pace in July 2021, driven by a combination of pent-up demand, economic stimulus, labor shortages, and raw material shortages. During the three months ending June 30th, consumer spending rose 11.8%—the second-fastest rate since 1952—with few signs of slowing down.

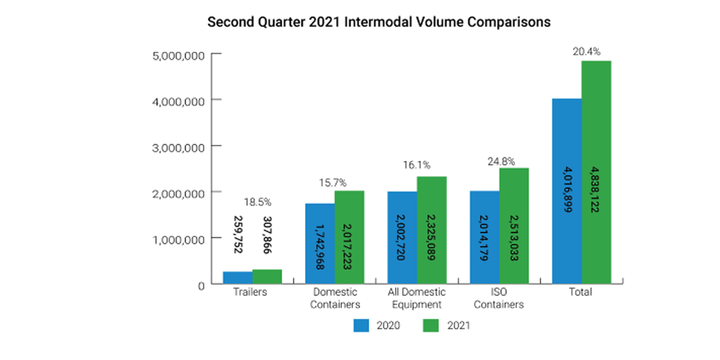

Shipping Volumes on the Rise – Source: Iana via TruckingInfo

According to TruckingInfo, total IMC volume rose nearly 30% year-over-year during the second quarter, while intermodal and highway loads were up almost 24% and 33.4%, respectively. These gains occurred across many regions, led by Trans-Canada with 29.6%, Southeast-Southwest at 28.9%, and Midwest-Northwest at 26.6% growth.

The significant increase in shipping volumes spurred higher dwell times at marine terminals with limited labor resources and storage. At the same time, some overseas manufacturers are causing last-second changes by ocean carriers over where a truck driver can deliver an empty container, forcing them to make extra trips and decreasing efficiency.

While the Delta variant could pose a risk to normalcy in late 2021 and early 2022, the strong job market and ongoing fiscal support could maintain momentum throughout the remainder of the year. Moreover, the shift from physical shopping at retailers to home deliveries could persist well beyond the pandemic as consumers prefer convenience.

Supply Constraints Limit Capacity

The sharp increase in demand comes along with shortages of drivers, trucks, chassis, and trailers across the industry.

The driver shortage is nothing new, but the COVID-19 pandemic certainly exacerbated the issue. For instance, there was a predictable wave of early retirements in an industry where the average worker is 48 years old. At the same time, new drug testing regulations limited the number of new eligible drivers to replace them—albeit for a good reason.

According to TTNews, the COVID-19 pandemic also forced more than 3,000 smaller trucking companies out of business. Many of these smaller companies relied on the spot market, which dried up in 2020 before rebounding sharply. The ATA reckons that these smaller companies and owner-operators represent more than 90% of all freight carriers.

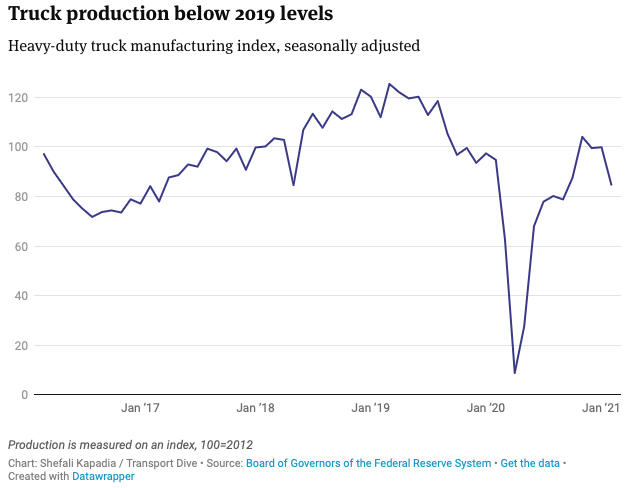

Truck Production is Still Below 2019 Levels – Source: Transport Dive

The same semiconductor shortages impacting the automotive market hit the trucking industry, too. According to Transport Dive, the lack of semiconductors will slow the production of Class 5 to Class 8 trucks in 2021. Fleets could be playing catch-up into 2022 as OEMs shift their production schedules and adjust to the shortage.

In addition to trucks, the trailer manufacturing business was hit by a lumber shortage earlier this year. The significant jump in lumber costs forced many fleets to delay purchasing new trailers due to their higher prices, exacerbating the shortage from high demand. Again, these shortages could take until 2022 to fully work out.

Finally, inefficiencies at ports have led to chassis shortages. The lead time to build new chassis is high due to raw material shortages, leading many companies to source broken chassis from graveyards. The problem is that many companies don’t want to use low-quality chassis due to the higher probability of breakdowns.

How to Deal with Capacity Issues

Technology will play a key role in resolving these issues in the near term and preventing similar problems in the future. At its core, technology improves fleet and asset visibility across the supply chain. Fleet managers can coordinate transportation, customers can see accurate delivery estimates, and manufacturers can track their shipments worldwide.

For example, Powerfleet provides a range of trailer, chassis and container telematics solutions and sensors to track location and status. That way, fleet managers can quickly assess their yard assets and make data-driven decisions to streamline their operations and improve efficiency. Dispatchers can also quickly see the status of a chassis or container without having to call drivers or shippers for updates.

Technology can also minimize damaged or stolen products. For example, telematics installed on reefer trailers can alert drivers and dispatch if refrigeration fails. Moreover, some telematics solutions can also provide remote control over the refrigeration unit to correct the temperature. In addition, freight cameras with door sensors can detect when a trailer door opens or closes and get visuals on the cargo loaded inside during transit to ensure it’s safe and sound.

In addition to better management of fleet assets, telematics can help improve driver retention by keeping drivers happier. For instance, Powerfleet’s in-cab ELD solutions automate many of the time-consuming manual paperwork drivers need to complete as well as track everything from gas mileage to harsh braking. This data can be used to support driver coaching or reward programs that incentivize safety.

Of course, technology will also play a vital role in intermodal transportation networks. Better visibility into chassis availability at ports and rail lines could help speed things up and make it easier to schedule driver pick-ups of containers or chassis. The key in many of these cases is knowing when containers are empty or loaded and when chassis are mounted or unmounted.

The Bottom Line

The COVID-19 pandemic significantly disrupted global supply chains. While an initial dropoff in demand reallocated resources elsewhere, the subsequent boom caught many companies off guard. Technology will play a critical role in resolving the industry’s current capacity issues while mitigating the impact of future disruptions through better planning.

If you’re interested in leveraging the latest telematics technologies across your fleet, contact us for a free consultation or find your local sales rep.