Combination Expected to Create Top-Tier Global Provider in Mobile Asset IoT Industry with Unparalleled Artificial Intelligence Enhanced SaaS Solution Portfolio

~1.7 Million Combined Subscriber Base Expected to Provide Immediate Scale

Expected to Create a Day One Business with Total Revenue of $279 Million, Including $210 Million of Recurring High-Margin SaaS Revenues and Combined Service Gross Margins of 67%

In Addition to Organic Growth, Combination is Expected to Unlock Significant Annual EBITDA Expansion Within First Two Years

Expected to Deliver Significant Cross-Sell and Upsell Opportunities for Powerfleet’s Unity Platform, Modular Software, and AI-Driven Data Solutions into Combined Base of 7,500 Enterprise Customers

Leadership Teams to Host Joint Conference Call Today, October 10, 2023 at 8:30 AM ET

Joint Investor Day Scheduled for Thursday, November 16, 2023 in New York City. Further Details Will Be Communicated Shortly

WOODCLIFF LAKE, NJ – October 10, 2023 – PowerFleet, Inc. (Nasdaq: AIOT) and MiX Telematics Limited (NYSE: MIXT, JSE: MIX) today announced that they have entered into a definitive agreement to form one of the largest mobile asset Internet of Things (IoT) Software-as-a-Service (SaaS) providers in the world. This powerful combination will form a scaled, global entity of choice focused on helping customers save lives, time, and money by solving mission-critical business challenges including safety and risk management, compliance, sustainability, and operational efficiency.

BUSINESS COMBINATION SUMMARY AND KEY DEVELOPMENTS

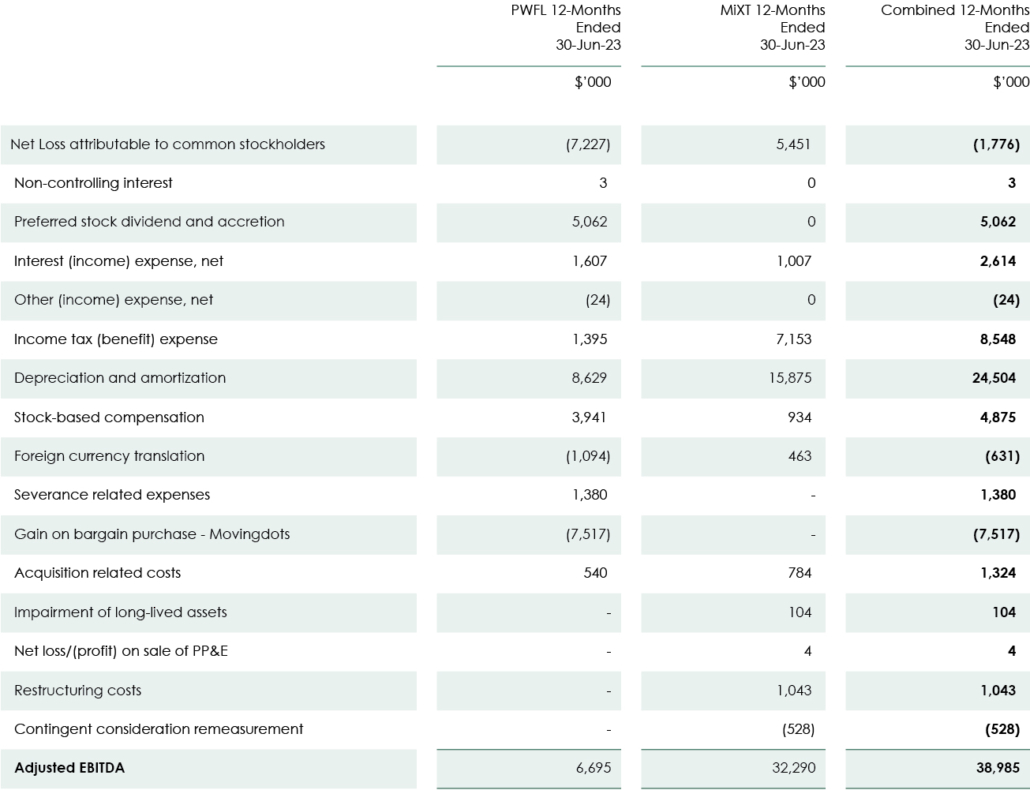

- Combined business with total revenue of $279 million, including $210 million in recurring high-margin SaaS revenue and $39 million of adjusted EBITDA for the trailing twelve-month (TTM) period ended June 30, 2023 (excluding selected non-cash and non-recurring items).

- The transaction is expected to close in the first quarter of calendar year 2024.

- Upon close, the combined business will be branded as Powerfleet, with its primary listing on Nasdaq.

MANAGEMENT COMMENTARY

“By leveraging our proven SaaS strategy across the combined business, spearheaded by our Unity platform and data highway, we firmly believe we will be extremely well positioned to drive incremental market consolidation. Realizing transformative scale, this transaction with MiX will provide the go-forward company with 1.7 million subscribers, and the ability to sell additive and accelerated AI and data-powered software solutions to a truly global set of customers,” said Steve Towe, Powerfleet’s Chief Executive Officer, who will continue serving as CEO of the combined Powerfleet company. “This combination is expected to achieve a number of strategic objectives including unlocking strong incremental value creation opportunities; a refinanced balance sheet for the combined company that will provide more flexibility to execute our strategic growth initiatives; and the ability to retain and attract an expanded portfolio of shareholders. Combining with MiX, an extremely well-run and profitable organization, will establish the combined entity as a world-class SaaS company, giving us the speed and capability to achieve improved growth in high quality recurring revenues and expanded profitability much sooner.”

Stefan Joselowitz, Chief Executive Officer at MiX Telematics, intends to retire at the conclusion of this transaction, but plans to continue to be a shareholder of the new combined entity. Joselowitz added, “I am extremely proud of our heritage and the high-quality business MiX is today, and I am delighted to have finally found an ideal partner that shares our values and strategic goals to take the company to the next level. We strongly believe that Powerfleet’s Unity strategy and our combined scale perfectly positions us to revolutionize the mobile asset IoT SaaS industry and drive transformative growth. As a shareholder I am very excited about how this combination will accelerate the achievement of our shared strategic goals.”

STRATEGIC RATIONALE

Compelling benefits expected from the transaction:

- Enhanced Shareholder Value: The transaction will immediately increase value to our existing and prospective shareholders with combined total revenue of $279 million and $39 million of adjusted EBITDA.The stronger balance sheet paired with the growth-centric capital structure is expected to propel the combined entity towards ambitious and achievable growth goals, including “Rule of 40” performance.

- Market Leadership: The combined company will create a top-tier mobile asset IoT SaaS organization with significant scale, serving all mobile asset types. The increased scale is expected to enable the combined entity to more efficiently serve our customers and create advantage to compete in an industry characterized by the need for high pace of development and innovation.

- Scale and Data Strategy: With a combined base of approximately 1.7 million subscribers following the transaction, the joint entity is expected to achieve significant scale as well as enhance our Unity platform strategy – including our AI-led data harmonization and integration capabilities.

- Research and Development Excellence: By integrating the Powerfleet and MiX world-class engineering and technology teams, the combined organization is expected to accelerate the delivery of top-class solutions with improved competitive advantage.

- Go-to-Market Acceleration and Increased Reach: Our combined geographical footprint, deep vertical expertise, and expanded software solution sets coupled with our extensive direct and indirect sales channel capabilities will enable us to maximize significant cross-sell and upsell opportunities within our impressive joint customer base.

- World-Class Talent: With more than 1,800 tenured and talented team members worldwide, the combined entity will focus on attracting and retaining top talent to deliver optimal value to our customers.

TRANSACTION TERMS AND FINANCING

MiX shareholders will exchange 100% of their outstanding MiX ordinary shares (including MiX ordinary shares represented by MiX American Depository Shares (ADSs), each of which represents 25 MiX ordinary shares) for consideration consisting of Powerfleet common shares, payable at closing. The number of Powerfleet common shares to be issued as consideration will be based on a post-transaction ownership structure, whereby current MiX shareholders will own approximately 65%, and current Powerfleet shareholders will own approximately 35% of the combined entity immediately following the closing of the transaction. This exchange ratio assumes all MiX issued ordinary shares (including those represented by MiX ADSs) are exchanged for common shares in Powerfleet.

In connection with the transaction, Powerfleet and MiX are positioned to secure $75 million in incremental debt which the companies anticipate will be fully executed at or before close. The proceeds from the refinancing of the combined company’s balance sheet will be used to redeem in full the outstanding convertible preferred stock held by affiliates of Abry Partners. Transaction-related expenses will be paid from cash on the balance sheet.

The closing of the transaction is subject to customary conditions, including required approvals of regulatory authorities and Powerfleet and MiX shareholders.

BOARD AND EXECUTIVE LEADERSHIP

Following the transaction, Steve Towe will remain CEO of Powerfleet and David Wilson will remain CFO. Stefan Joselowitz, current CEO of MiX, will be retiring.

A new board of directors of Powerfleet will be formed. Michael Brodsky will be Chairman. Steve Towe will be on the board. Ian Jacobs, MiX Telematics’ current Chairman, will be joining the board. MiX will appoint one additional board member and further board member appointments will be made by mutual consent.

CONFERENCE CALL AND WEBCAST

Powerfleet and MiX Telematics management will host a joint conference call to discuss the transaction today, October 10, 2023 at 8:30 a.m. Eastern time (5:30 a.m. Pacific time).

Toll Free: 888-506-0062

International: 973-528-0011

South Africa: 080-098-3458

Participant Access Code: 193766

Webcast

The conference call will be available for replay here.

If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

A supplemental slide presentation regarding the transaction will be available on the investor relations section of each company’s website.

TRANSACTION ADVISORS

William Blair & Company L.L.C. is acting as financial advisor, and Olshan Frome Wolosky LLP and Webber Wentzel are acting as legal advisors to Powerfleet. Raymond James and Java Capital are acting as financial advisors to MiX Telematics, and DLA Piper LLP (US) and Java Capital are acting as legal advisors to MiX Telematics. Gateway Group is acting as investor relations advisor to Powerfleet and MiX Telematics.

RECONCILIATION OF EBITDA TO GAAP FINANCIAL MEASURE

ABOUT POWERFLEET

Powerfleet (Nasdaq: AIOT; TASE: PWFL) is a global leader of internet of things (IoT) software-as-a-service (SaaS) solutions that optimize the performance of mobile assets and resources to unify business operations. Our data science insights and advanced modular software solutions help drive digital transformation through our customers’ and partners’ ecosystems to help save lives, time, and money. We help connect companies, enabling customers and their customers to realize more effective strategies and results. Powerfleet’s tenured and talented team is at the heart of our approach to partnership and tangible success. The company is headquartered in Woodcliff Lake, New Jersey, with our Pointer Innovation Center (PIC) in Israel and field offices around the globe. For more information, please visit idsy2019.wpengine.com.

ABOUT MIX TELEMATICS

MiX Telematics is a leading global provider of fleet and mobile asset management solutions delivered as SaaS to over 1 million global subscribers spanning more than 120 countries. The company’s products and services provide enterprise fleets, small fleets, and consumers with efficiency, safety, compliance, and security solutions. MiX Telematics was founded in 1996 and has offices in South Africa, the United Kingdom, the United States, Uganda, Brazil, Mexico and Australasia as well as a network of more than 130 fleet partners worldwide. MiX Telematics shares are publicly traded on the Johannesburg Stock Exchange (JSE: MIX) and the New York Stock Exchange (NYSE: MIXT). For more information, visit www.mixtelematics.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of federal securities laws. Powerfleet’s, MiX’s and the combined business’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the parties’ expectations with respect to their beliefs, plans, goals, objectives, expectations, anticipations, assumptions, estimates, intentions and future performance, as well as anticipated financial impacts of the proposed transaction, the satisfaction of the closing conditions to the proposed transaction and the timing of the completion of the proposed transaction. Forward-looking statements involve significant known and unknown risks, uncertainties and other factors, which may cause their actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. Most of these factors are outside the parties’ control and are difficult to predict. The risks and uncertainties referred to above include, but are not limited to, risks related to: (i) the completion of the proposed transaction in the anticipated timeframe or at all; (ii) the satisfaction of the closing conditions to the proposed transaction including, but not limited to the ability to obtain approval of the stockholders of Powerfleet and shareholders of MiX and the ability to obtain financing; (iii) the failure to obtain necessary regulatory approvals; (iv) the ability to realize the anticipated benefits of the proposed transaction; (v) the ability to successfully integrate the businesses; (vi) disruption from the proposed transaction making it more difficult to maintain business and operational relationships; (vii) the negative effects of the announcement of the proposed transaction or the consummation of the proposed transaction on the market price of MiX’s or Powerfleet’s securities; (viii) significant transaction costs and unknown liabilities; (ix) litigation or regulatory actions related to the proposed transaction; and (x) such other factors as are set forth in the periodic reports filed by MiX and Powerfleet with the Securities and Exchange Commission (“SEC”), including but not limited to those described under the heading “Risk Factors” in their annual reports on Form 10-K, quarterly reports on Form 10-Q and any other filings made with the SEC from time to time, which are available via the SEC’s website at http://www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this press release are made only as of the date of this press release, and except as otherwise required by applicable securities law, neither MiX nor Powerfleet assumes any obligation nor do they intend to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction, Powerfleet intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Powerfleet and MiX and a prospectus of Powerfleet. Furthermore, Powerfleet intends to procure a secondary inward listing on the Johannesburg Stock Exchange to accommodate existing and future South African shareholders.

Additionally, MiX intends to prepare a scheme circular for MiX shareholders in accordance with the Companies Act of South Africa (including the Companies Act Regulations, 2011 thereunder) and the JSE’s listings requirements with respect to a shareholder meeting at which MiX shareholders will be asked to vote on the proposed transaction. The scheme circular will be issued to MiX shareholders together with the proxy statement/prospectus. If you hold MiX ordinary shares through an intermediary such as a broker/dealer or clearing agency, or if you hold MiX ADSs, you should consult with your intermediary or The Bank of New York Mellon, the depositary for the MiX ADSs, as applicable, about how to obtain information on the MiX shareholder meeting.

After Powerfleet’s registration statement has been filed and declared effective by the SEC, Powerfleet will send the definitive proxy statement/prospectus to the Powerfleet shareholders entitled to vote at the meeting relating to the proposed transaction, and MiX will send the scheme circular, together with the definitive proxy statement/prospectus, to MiX shareholders entitled to vote at the meeting relating to the proposed transaction. MiX and Powerfleet may file other relevant materials with the SEC in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN), THE SCHEME CIRCULAR AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about Powerfleet and MiX once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. Powerfleet or MiX make available copies of materials they file with, or furnish to, the SEC free of charge at https://ir.powerfleet.com and http://investor.mixtelematics.com, respectively.

NO OFFER OR SOLICITATION

This communication shall not constitute an offer to buy or sell any securities, or the solicitation of an offer to buy or sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

PARTICIPANTS IN THE SOLICITATION

Powerfleet, MiX and their respective directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the shareholders of Powerfleet and MiX in connection with the proposed transaction. Securityholders may obtain information regarding the names, affiliations and interests of Powerfleet’s directors and executive officers in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 31, 2023, its amended Annual Report on Form 10-K/A for the year ended December 31, 2022, which was filed with the SEC on May 1, 2023, and its definitive proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on June 21, 2023. Securityholders may obtain information regarding the names, affiliations and interests of MiX’s directors and executive officers in its Annual Report on Form 10-K for the year ended March 31, 2023, which was filed with the SEC on June 22, 2023, and its definitive proxy statement for its 2023 annual general meeting of shareholders, which was filed with the SEC on July 28, 2023. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Powerfleet or MiX using the sources indicated above.

Powerfleet Investor Contact

Matt Glover

Gateway Group, Inc.

PWFL@gateway-grp.com

+1 (949) 574-3860

Powerfleet Media Contact

Andrea Hayton

ahayton@powerfleet.com

+1 (610) 401-1999

MiX Telematics Investor Contact

Cody Cree

Gateway Group, Inc.

+1 (949) 574-3860

MIXT@gateway-grp.com

MiX Telematics Media Contact

Jonathan Bates

jonathan.bates@mixtelematics.com

+44 7921 242892

###